We can't find the internet

Attempting to reconnect

Something went wrong!

Hang in there while we get back on track

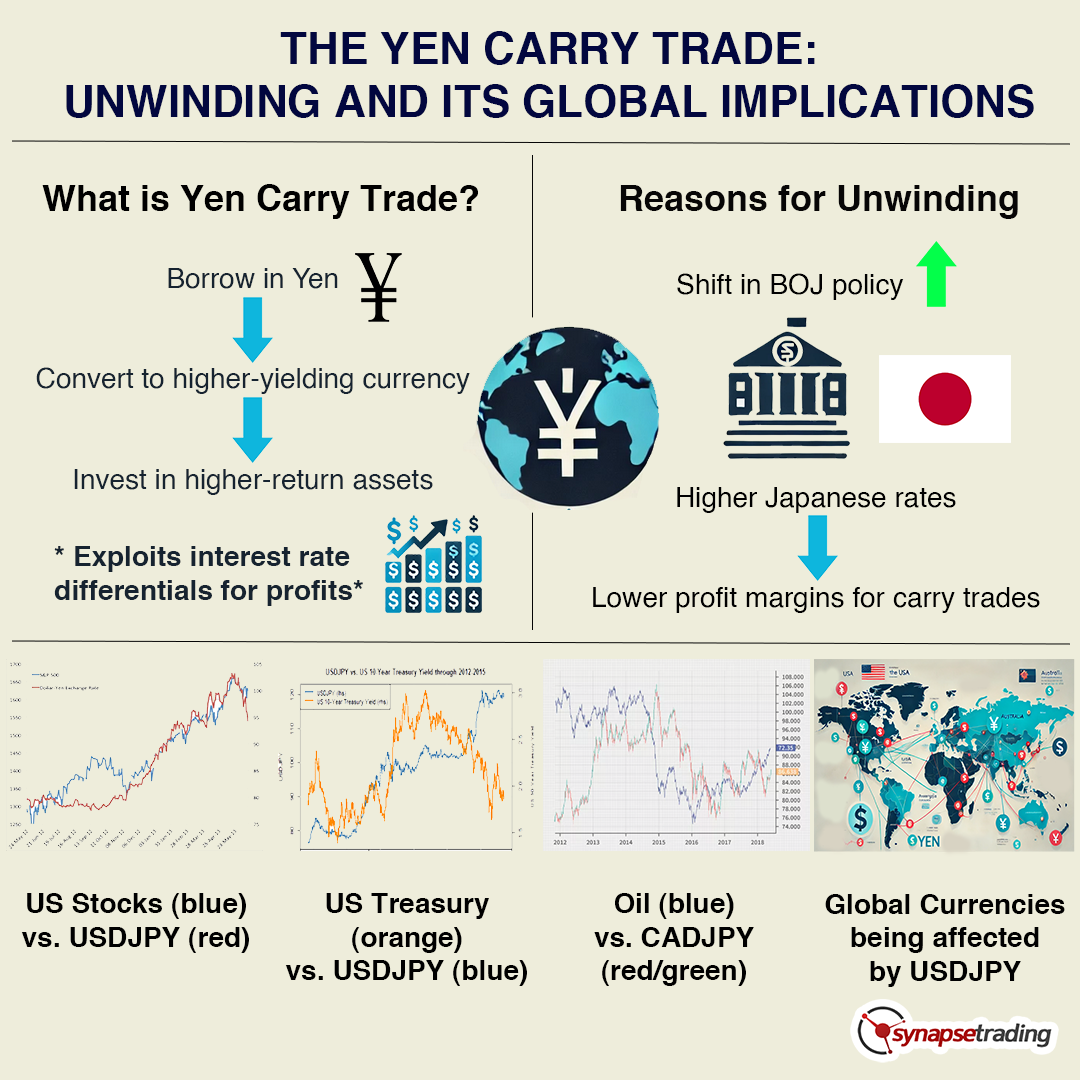

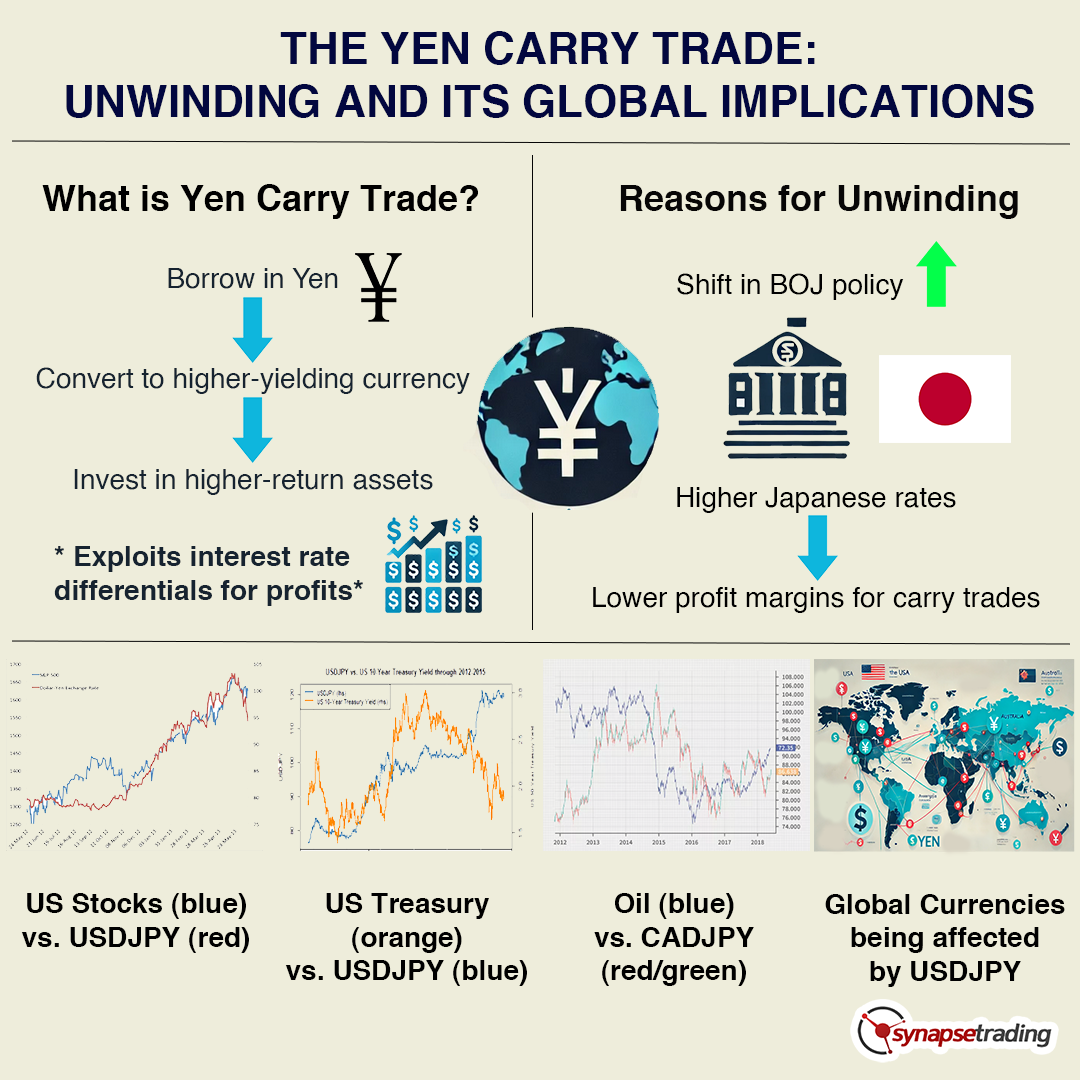

Understanding the Importance of the Yen Carry Trade

The importance of the yen carry trade lies in its wide-ranging effects when it is initiated or, particularly, when it is unwound.

The yen carry trade is considered important primarily due to its significant impact on global financial markets and economic stability. This strategy involves borrowing Japanese yen at low interest rates and investing the proceeds in higher-yielding assets denominated in other currencies.[1][3][4] The popularity of this trade stems from the Bank of Japan's (BOJ) long-standing ultra-loose monetary policy, which has kept interest rates at or near zero, making the yen an attractive currency to borrow.[1][3][4]

When the yen carry trade is unwound, often triggered by changes in interest rate differentials (such as a BOJ rate hike or potential rate cuts by other central banks like the Federal Reserve) or increased market volatility, it can lead to dramatic selloffs across global markets.[1][2] For instance, a recent unwinding event saw global equities and digital assets undergo a significant selloff, with indices like the S&P Global Broad Market Index and the Tokyo Stock Price Index experiencing sharp declines, and the Bloomberg Galaxy Crypto Index tumbling.[1] The unwinding involves investors selling the higher-yielding assets and buying back yen to repay their loans, which can cause sudden and significant movements in exchange rates and asset prices.[4]

Historically, the yen's appreciation during unwinding periods has mirrored past financial crises, such as the 1998 Long-Term Capital Management collapse and the 2007 subprime mortgage crisis, highlighting the potential for systemic risk.[1] The large-scale borrowing and investing activities associated with the yen carry trade contribute to increased volatility in currency markets.[4]

Furthermore, the yen carry trade influences the monetary policy decisions of central banks, including the Bank of Japan, as they must consider the trade's potential impact on currency values and financial stability.[4] The strategy has also been linked to the inflation of asset prices in higher-yielding currencies and asset classes, raising concerns about asset bubbles and potential market corrections.[4] It can also distort economic fundamentals as investors focus on interest rate differentials rather than underlying economic conditions.[4]

The future trajectory of the yen carry trade and its impact are closely tied to factors such as the evolution of the U.S. economy and the Federal Reserve's policy decisions regarding interest rates.[2] Continued unwinding could occur if the gap between Japanese and other countries' interest rates narrows further.[1][2]

In summary, the yen carry trade is important because it is a widely used strategy that, while profitable under stable conditions, carries the potential for significant disruption, increased volatility, and risks to financial stability when it unwinds, impacting global equity, currency, and asset markets, and influencing central bank policies.[1][2][4]

Authoritative Sources

- Understanding the Yen Carry Trade Impact on World Markets. [Understanding the Yen Carry Trade Impact on World Markets]↩

- What the Carry Trade Had to Do With Monday Stock Market Rout. [What the Carry Trade Had to Do With Monday Stock Market Rout]↩

- Yen carry trade: why did it cause a market sell-off? [Yen carry trade: why did it cause a market sell-off?]↩

- Understanding Yen Carry Trade and Its Impact. [Understanding Yen Carry Trade and Its Impact]↩

Sign up for free to save this answer and access it later

Sign up →