We can't find the internet

Attempting to reconnect

Something went wrong!

Hang in there while we get back on track

The coworking industry is undergoing a significant transformation in 2025, characterized by strategic recalibration, a shift towards larger and more efficient spaces, and increasing momentum in secondary markets. While the sector experienced robust growth in Q1 2025, Q2 saw a deceleration, indicating a move from aggressive expansion to portfolio optimization and rationalization. This shift is driven by evolving hybrid work demands and economic pressures, leading flexible office operators to consolidate, with smaller players being absorbed or exiting the market, and larger providers strengthening their presence in key locations for long-term resilience [1].

According to www.iAsk.Ai - Ask AI:

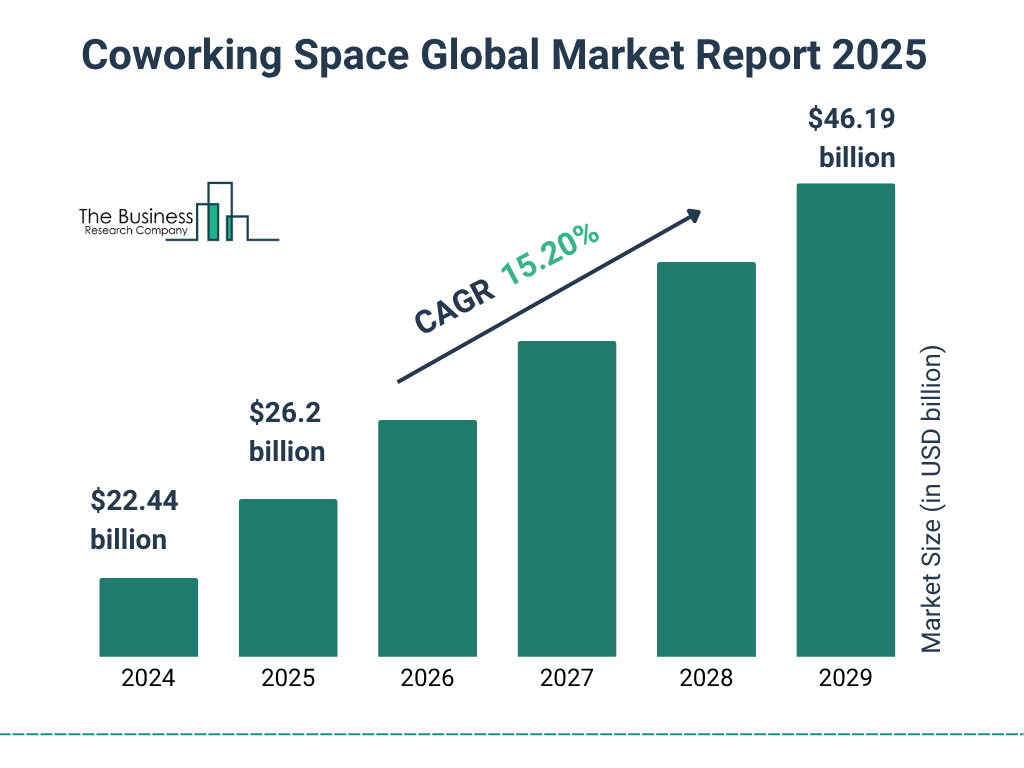

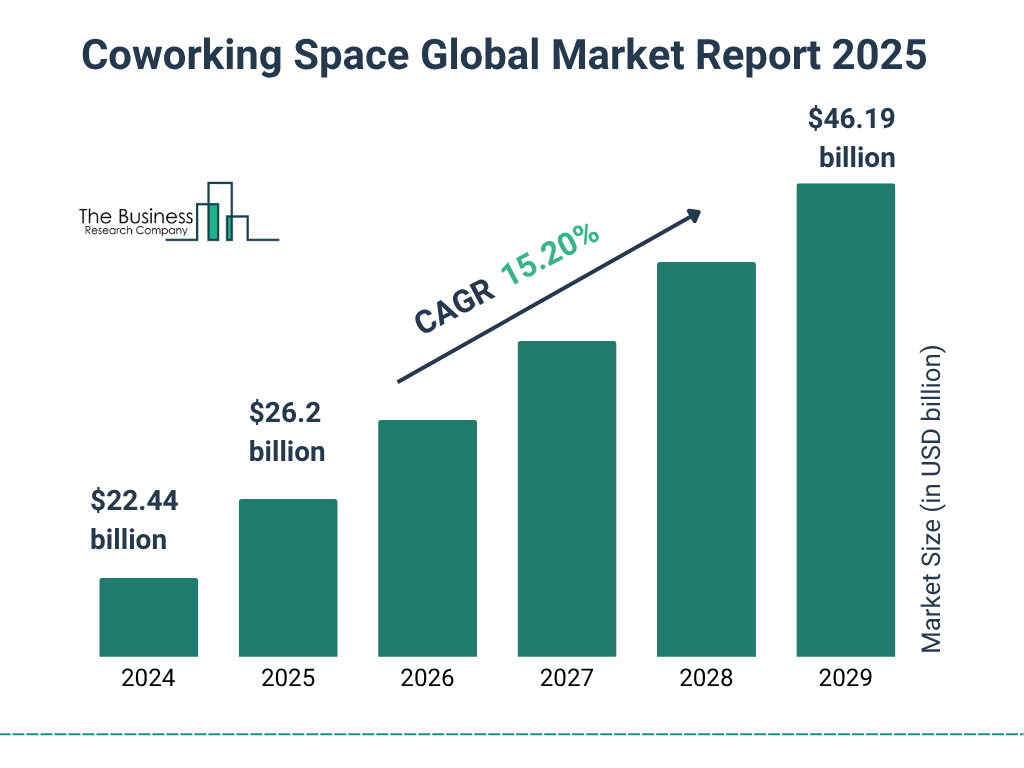

The global coworking market was valued at $22.01 billion in 2024 and is projected to grow to $25.11 billion in 2025, with expectations to reach $82.12 billion by 2034 at a compound annual growth rate (CAGR) of 14.1% [2]. This growth is fueled by several factors, including the increasing number of freelancers and startups, the widespread adoption of hybrid and remote work models by businesses, and the growing interest from large corporations in utilizing flexible workspaces for their teams [2] [3]. Cost savings, government support for entrepreneurs, and technological advancements in coworking management software also contribute to this expansion [2].

In the U.S., the flexible workspace market saw a marginal rise of 0.4% in Q2 2025, reaching approximately 141.29 million square feet, a sharp contrast to the 3% surge in Q1 [1]. The total number of coworking locations in the U.S. declined by 1% in Q2, falling to 7,748 from 7,840 in the previous quarter, marking the first contraction in the post-COVID era [1]. This indicates a strategic shift among operators towards streamlining portfolios for profitability and efficiency, prioritizing occupancy rates and average location size over raw expansion [1].

Geographically, the trends are nuanced. Manhattan, NY, the largest coworking market by space allocation, experienced a 4% shrinkage in its total footprint and a 5% drop in location count in Q2 2025. However, the average size of its remaining spaces increased modestly, signaling a pivot towards fewer, but larger, high-end venues [1]. In contrast, emerging markets such as Long Island, NY (11% increase), Birmingham, AL (10% gain), and West Palm Beach-Boca Raton, FL (9% boost), recorded substantial footprint gains, demonstrating operators' increasing appetite for less-saturated, secondary markets [1]. Brooklyn, NY, also showed strong growth with a 5% increase in flexible offices, reflecting a demand for flexible work environments in less traditional neighborhoods [1].

Leading operators like Regus and HQ are solidifying their market lead through strategic portfolio management. Regus, the largest coworking operator, increased its national footprint by 6% to 1,141 locations by Q2 2025, while HQ saw an impressive 14% nationwide increase to 319 locations [1]. Industrious and Spaces also posted steady gains, and WeWork's footprint stabilized with a slight 1% increase, consistent with its restructuring efforts [1].

The average size of coworking locations nationally increased by 2% in Q2 2025 to 18,236 square feet, reflecting a clear shift towards fewer but larger spaces with enhanced amenities to meet the evolving needs of hybrid workers and enterprise clients [1]. This trend is evident in markets like Manhattan, with an average size of 40,859 square feet, and emerging markets like Long Island, NY, and West Palm Beach-Boca Raton, FL, which saw significant growth in average location size [1].

Pricing trends show that Manhattan, NY, remains the most expensive coworking market, with an average monthly membership price of $339 [1]. Virtual office pricing also saw significant highs outside downtown cores, indicating rising demand for remote-first business setups in cost-conscious, commuter-friendly zones [1].

The industry is also seeing a deepening of several key trends:

- Shift to Private Offices: Demand for private offices has officially outpaced hot desks, with private offices now taking up around 80% of space allocation in many spaces [4].

- Alternative Revenue Streams: Coworking spaces are diversifying their revenue beyond desk rentals, focusing on offerings like phone booths, event spaces, alternative use spaces (e.g., yoga rooms, podcast studios), and virtual mail programs [4].

- Improved Profitability: While challenges remain, profitability in the coworking sector is improving, especially for spaces that have matured (4-6 years old, 100-249 members, 10,000-20,000 sq ft) [4].

- Hospitality and Experience: Coworking spaces are increasingly adopting a hospitality-centric approach, focusing on service, ambiance, and curated experiences to attract and retain members [4] [5].

- Corporate Clients: Large corporations are becoming a significant client segment, utilizing coworking spaces for their remote teams, satellite offices, and short-term projects, driving demand for flexible, hospitality-driven spaces [2] [4] [5].

- Automation and AI: Technology, particularly AI, is transforming coworking operations, enhancing sales, analytics, and member experiences, and streamlining daily tasks [2] [4] [5]. AI-powered pricing models have helped some operators boost revenue by over 50% [2].

- Niche Coworking Spaces: There's a growing trend towards specialized coworking spaces catering to specific industries (e.g., Med-Tech, fashion) or demographics (e.g., women, creatives, working parents), fostering stronger communities and tailored amenities [4] [5] [6].

- Suburban and Small-Town Expansion: With remote workers migrating to more affordable areas, suburban and small-town coworking spaces are booming, offering community and professional workspaces closer to home [4] [6].

Challenges persist, including profitability struggles for nearly half of surveyed coworking spaces, intense competition from large brands and landlords converting vacant offices, and the ongoing need to attract and retain members amidst fluctuating occupancy rates and economic uncertainty [2] [4]. However, the industry remains optimistic, with expectations of continued growth, increased investment, and a focus on innovation and adaptability to meet the evolving demands of the future of work [2] [5].

Authoritative Sources

- National Coworking Report. [CoworkingCafe]↩

- Coworking Statistics. [ArchieApp]↩

- The Indian office market is undergoing a seismic shift. [CoworkingInsights]↩

- Coworking Trends. [OptixApp]↩

- The Top 10 2025 Coworking Megatrends: A Renaissance in the Making. [Allwork.Space]↩

- What’s New in the Coworking Industry in 2025? [The Executive Centre]↩

- The future is bright for the coworking space industry. [OfficeRND]↩

- National Coworking Report Q1 2025. [CoworkingCafe]↩

Sign up for free to save this answer and access it later

Sign up →