The rodeo market is experiencing a period of significant growth and expansion, driven by increased media attention, strategic marketing, and a surging interest in Western culture. This positive outlook is reflected in rising ticket sales, expanding media rights deals, and a growing economic impact on host cities [1] [2] [3] [4].

According to www.iAsk.Ai - Ask AI:

The rodeo market outlook is currently very positive, characterized by significant growth in audience engagement, economic impact, and media presence, with continued expansion into new markets and increased commercialization.

Current Market Trends and Growth Drivers

The Professional Bull Riders (PBR), often referred to as the "NFL of rodeo," has seen a substantial increase in popularity. Between 2022 and 2023, PBR experienced a 23% increase in ticket sales and sold out 38 separate events, with over one million people attending PBR events in 2023 [2]. Social media engagement is also booming, with PBR's TikTok and Instagram accounts each boasting over 2.5 million followers [2]. This growth is attributed to several factors:

- "Yellowstone Effect" and Western Culture Resurgence: The popularity of shows like Paramount+'s Yellowstone and its spin-offs, along with cultural phenomena like Beyoncé's Cowboy Carter and Pharrell Williams' Wild West-inspired Louis Vuitton collection, have propelled the cowboy aesthetic into the mainstream. This cultural zeitgeist has significantly boosted interest in rodeo and Western sports [2] [3].

- Increased Media Exposure: PBR has secured new media-rights agreements with CBS Sports and Dr. Phil’s Merit Street Media, leading to expanded distribution, more consistent broadcast windows, and increased live TV airtime. These deals also include greater coverage of women's rodeo, building on an existing audience of 31 million viewers on CBS in 2023 alone [2] [3].

- Expansion into Nontraditional Markets: PBR is actively taking the sport beyond its traditional Western roots, hosting events in cities like Brooklyn, Pittsburgh, Albany, and Fort Lauderdale. This strategy aims to tap into new fan bases and revenue streams [2] [3]. For example, Pittsburgh, which had banned rodeo in 1992, recently repealed the ban, leading to PBR announcing its first event there in January 2025 [2].

- Commercialization and Sponsorships: The rodeo ecosystem is increasingly commercialized, with significant revenue generated from sponsorships, advertising, and merchandise sales. Brands like Wrangler, the U.S. Air Force Reserve, Monster Energy, Yeti, Cooper Tire, and various alcohol companies are partnering with PBR [2] [3]. Celebrity involvement, such as Larry the Cable Guy investing in bulls, further highlights the growing commercial appeal [3]. The Western-wear industry itself is projected to soar to over $136 billion by 2031 [2].

- Team-Based Formats: PBR has introduced team events, such as the nationwide series where two teams of five bull riders compete, to make the sport more accessible and understandable for new and casual fans, particularly in nontraditional locales [2].

Economic Impact

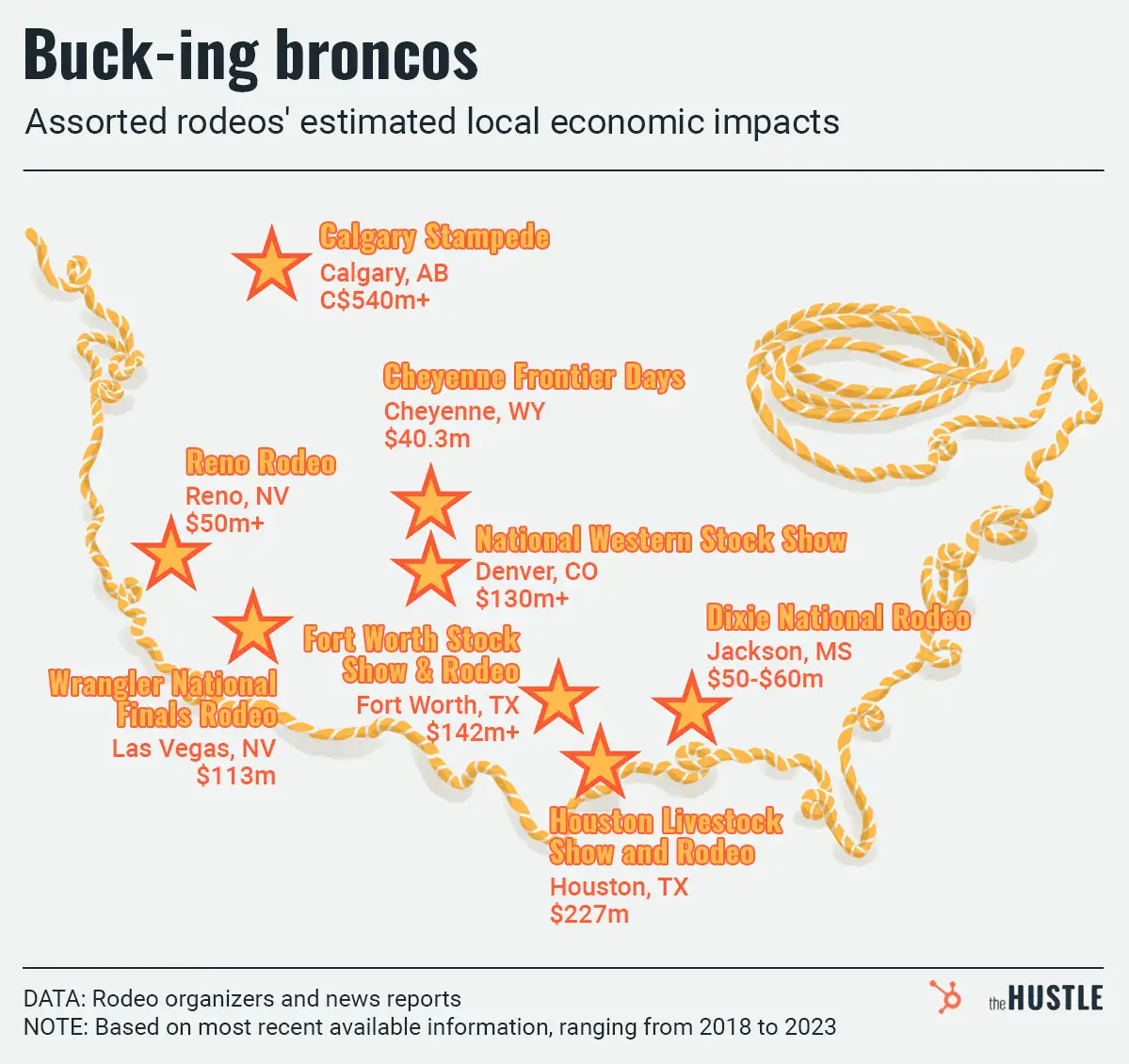

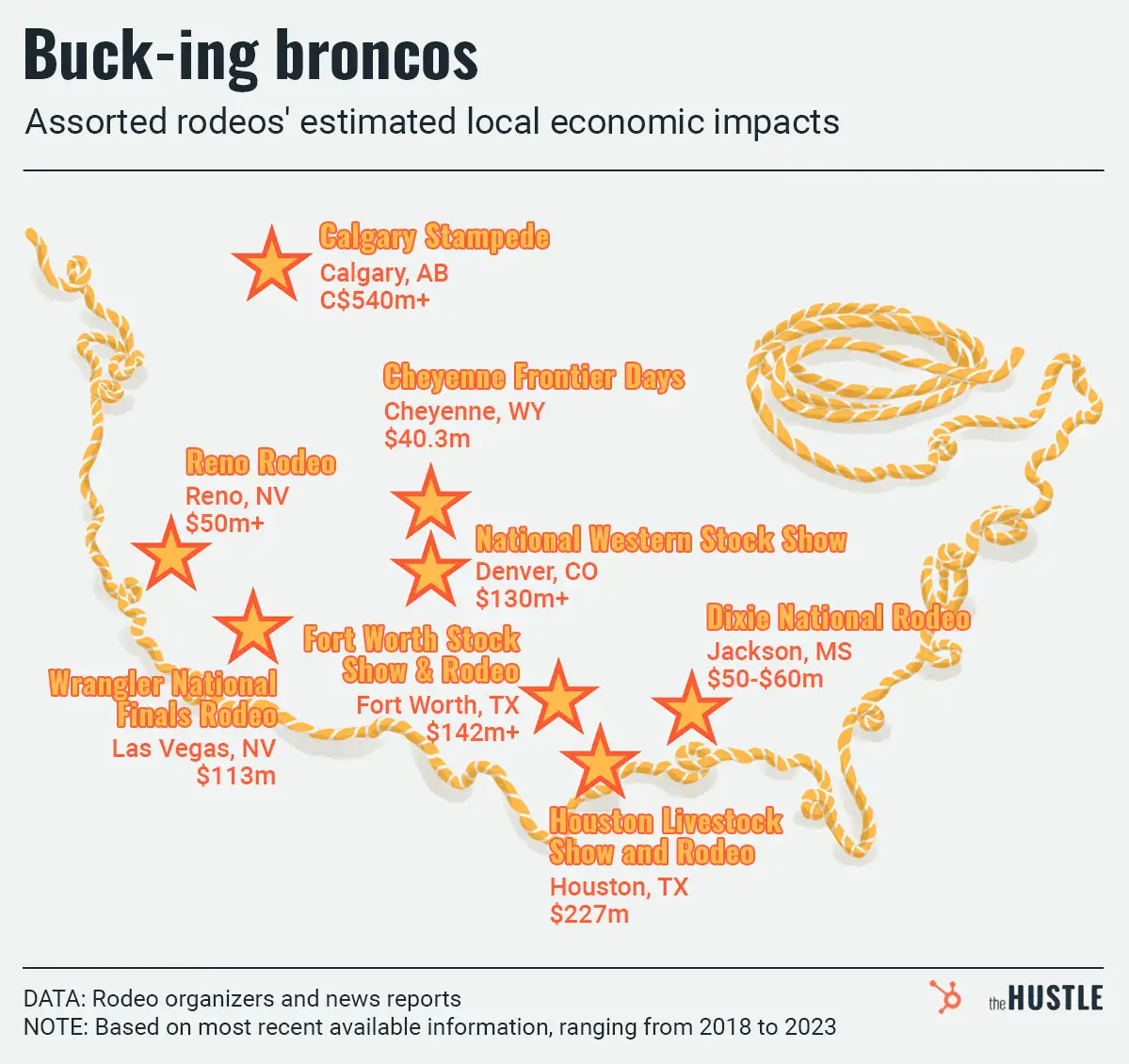

Rodeos are significant economic drivers for their host cities. Events like Cheyenne Frontier Days, the Calgary Stampede, and the Houston Livestock Show and Rodeo generate hundreds of millions of dollars annually [2]. For instance, the 2023 Cheyenne Frontier Days generated over $40 million for its local economy [2]. The Houston Livestock Show and Rodeo also conducts detailed economic impact studies, quantifying new spending, job support, and tax revenue generated in the Greater Houston area [1].

Challenges and Future Adaptations

Despite the positive outlook, the rodeo market faces challenges, primarily from animal rights activists who accuse the sport of animal abuse. Some cities, including Fort Wayne, Indiana, and Pasadena, California, have banned rodeo sports, and a bill to ban rodeo in Los Angeles is currently working its way through committee [2]. PBR argues that injuries to bulls are rare and that activists often misunderstand the sport [2].

To ensure continued growth and sustainability, the rodeo industry may adapt by:

- Further Media Rights Deals: Following models in other equestrian disciplines like dressage and show jumping, rodeos could secure more robust sponsorship deals and lucrative prize money [3].

- Strategic Partnerships: Prestigious events like the National Finals Rodeo (NFR) may adapt their structures to accommodate evolving industry trends, including strategic partnerships [3].

- Addressing Animal Welfare Concerns: Proactive measures and transparent communication regarding animal care could help mitigate criticism from animal rights groups [2] [3].

The financial realities for professional rodeo athletes also involve significant costs for travel and equipment, making it a demanding career [3]. However, top riders can achieve substantial financial success through prize money, sponsorships, and endorsements [3].

In conclusion, the rodeo market is experiencing a robust period of growth, fueled by cultural trends, strategic expansion, and increasing commercialization. While challenges exist, the industry's resilience and adaptability suggest a promising future [2] [3] [4].

Authoritative Sources

- Economic Impact. [RodeoHouston]↩

- PBR, Pro Rodeo Expanding With American Western Culture Moment. [Front Office Sports]↩

- Wrangling Revenue: A Deep Dive into the Economics of Rodeo. [The Pegasus App Blog]↩

- Rodeo Housing Market. [Redfin]↩

Sign up for free to save this answer and access it later

Sign up →